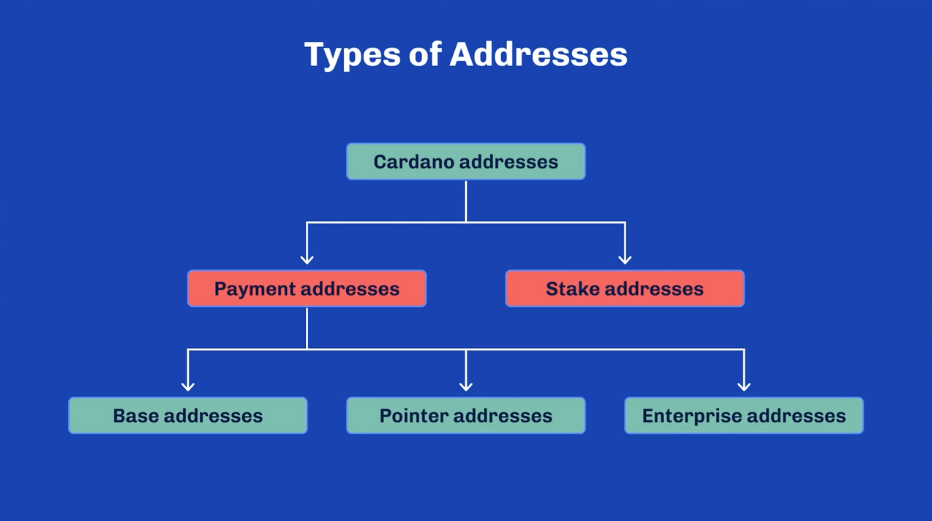

In the Cardano ecosystem, there are two primary types of addresses: payment addresses and stake addresses. Payment addresses are used for sending, receiving, and holding ADA or other native tokens, while also supporting staking and delegation in certain configurations. These addresses allow users to transact and participate in the Proof-of-Stake (PoS) mechanism. Stake addresses, on the other hand, are specifically designed to receive staking rewards. These addresses are associated with stake keys and cannot be used for normal transactions, making them a secure and dedicated channel for distributing staking incentives to participants in the network’s PoS system. Both types of addresses play vital roles in enabling Cardano’s secure and scalable blockchain ecosystem.

1. Payment Addresses

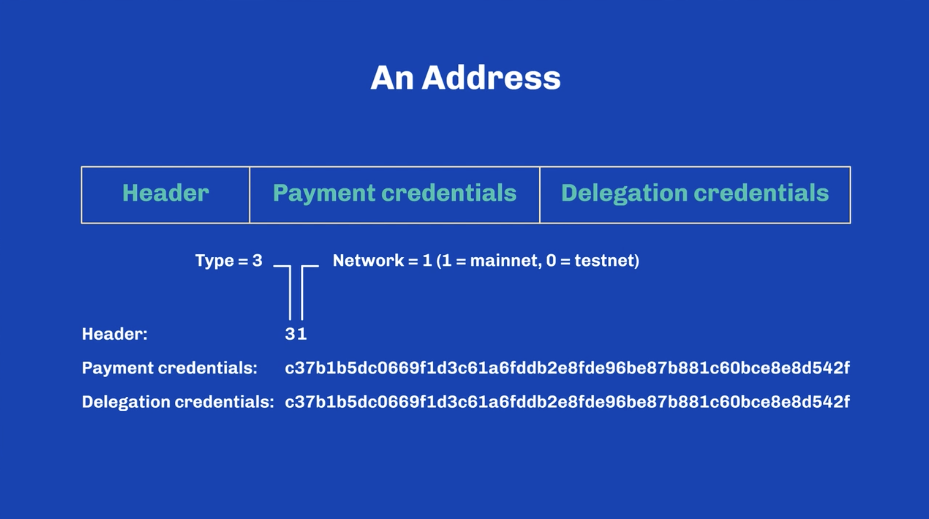

Each payment address in Cardano consists of three distinct parts: the header, the payment credential, and the delegation credential. These elements work together to define the functionality of the address, from its basic role in transactions to its involvement in the network’s Proof-of-Stake (PoS) consensus mechanism. Let’s explore each component in detail.

The Three Parts of a Payment Address

- Header: The header of a Cardano payment address encodes two important pieces of information: the type of address and the network identifier.

- Type of Address: This part of the header specifies the role of the address. For example, a base address is designed for both payments and staking, while an enterprise address is solely for payments and does not participate in staking. There are also other address types, such as pointer addresses and reward addresses, but the base address is the most common for general usage.Network Identifier: The header also encodes whether the address is used on the mainnet or testnet. This ensures that addresses for test purposes cannot be confused with those on the live network. A network identifier of

1indicates the address belongs to the mainnet, while0denotes the testnet.

- Type of Address: This part of the header specifies the role of the address. For example, a base address is designed for both payments and staking, while an enterprise address is solely for payments and does not participate in staking. There are also other address types, such as pointer addresses and reward addresses, but the base address is the most common for general usage.Network Identifier: The header also encodes whether the address is used on the mainnet or testnet. This ensures that addresses for test purposes cannot be confused with those on the live network. A network identifier of

- Payment Credential: The payment credential is arguably the most critical component, as it defines the ownership of the funds associated with the address.

- Key Hash: In most cases, the payment credential is a key hash derived from a user’s public key. The public key is generated when a Cardano wallet is created, and the corresponding private key is used to sign transactions, ensuring that only the rightful owner can spend the ADA or tokens at the addressScript Hash: In more advanced use cases, such as smart contracts or multi-signature (multisig) setups, the payment credential could be a script hash. This means that funds can only be spent if certain conditions defined by the script are met, such as requiring multiple signatures from different parties. This component ensures that the funds at the address are securely tied to either a public key or a script, making it possible for users to transact confidently within the Cardano network.

- Delegation Credential: The delegation credential allows an address to participate in Cardano’s Proof-of-Stake (PoS) system by linking it to a stake key or script hash. This credential is essential for staking and delegation, enabling users to help secure the network while earning rewards.

- Stake Key: For most users, the delegation credential is tied to their stake key, a cryptographic identifier used to delegate ADA to a stake pool. This allows the user to participate in staking while keeping full control of their funds. The rewards earned from staking are distributed based on the amount of ADA delegated and the performance of the chosen stake pool.

- Script Hash: Like the payment credential, the delegation credential can also be a script hash in more complex scenarios, such as when multiple parties are involved in delegating ADA to a pool. In this case, the rules for delegation and staking rewards are defined by the script.

How the Three Parts Work Together

These three components — the header, payment credential, and delegation credential — combine to give Cardano payment addresses their unique flexibility and functionality. Here’s how they work in practice:

- The header ensures that the address can only function on the correct network and defines whether the address supports staking or is strictly for payments.

- The payment credential secures the funds, ensuring that only the owner (or script) can control the assets within the address.

- The delegation credential enables staking, linking the address to a stake key or script so that the ADA at the address can participate in securing the network and earn rewards.

This combination of features ensures that users can securely hold, spend, and stake their ADA, while also supporting more complex use cases like multi-signature wallets or smart contracts.

Types of Payment Addresses

In the Cardano ecosystem, payment addresses come in different forms to accommodate various use cases, from simple payments to more complex staking and delegation functionalities. The three primary types of payment addresses are base addresses, pointer addresses, and enterprise addresses. Each address type serves a different purpose and has its own specific features within Cardano’s Extended UTXO (eUTXO) model.

1. Base Addresses

Base addresses are the most commonly used type of address in Cardano. They are versatile, supporting both payments and staking functionalities, making them ideal for users who want to participate in staking (delegation to a stake pool) while still holding and transferring ADA and other native tokens.

Key Features:

- Staking Support: Base addresses include a delegation credential, which links the address to a stake key. This allows the ADA in the address to be staked or delegated to a stake pool, earning staking rewards.

- Two Credentials: A base address contains both a payment credential (which controls who can spend the funds) and a delegation credential (which allows the address to participate in staking).

- Flexibility: Base addresses are highly flexible, combining payments with staking. A user can hold ADA in a base address, send payments, and simultaneously earn rewards through staking.

Example Use Case:

If you want to both hold ADA in your wallet and delegate that ADA to a stake pool for staking rewards, you would use a base address. This address allows you to receive and send payments while participating in the network’s Proof-of-Stake consensus mechanism.

Structure:

- Payment Credential: Controls the ownership of ADA and native tokens.

- Delegation Credential: Links to a stake key, enabling delegation and staking.

2. Pointer Addresses

Pointer addresses are more specialized and less common than base addresses. They are designed to simplify the process of interacting with staking certificates by referencing (or “pointing to”) the stake credentials indirectly through pointers to specific blockchain locations. This makes it easier to manage staking without needing to embed the full stake key into the address.

Key Features:

- Efficiency: Instead of embedding the stake key directly in the address, pointer addresses include a pointer that refers to a specific staking certificate on the blockchain. This reduces the size of the address.

- No Direct Stake Key: The delegation credential in pointer addresses is not explicit; instead, it points to a specific position in the blockchain that holds the delegation certificate.

- Lightweight Staking: Pointer addresses make it easier for certain dApps and services to manage staking relationships by referencing the staking data in a more efficient manner.

Example Use Case:

A pointer address is useful for decentralized applications or services where users need to reference staking-related data indirectly without embedding full staking information in the address. It’s more efficient when you don’t want to carry all the staking information within the address itself but still need the delegation functionality.

Structure:

- Payment Credential: Controls the ownership of ADA and native tokens.

- Pointer: Refers to a specific location on the blockchain where the delegation/stake key information is stored.

3. Enterprise Addresses

Enterprise addresses are simpler than base and pointer addresses and are designed solely for payments. They do not support staking or delegation, making them ideal for businesses or entities that only need to handle transactions and are not interested in participating in the Proof-of-Stake (PoS) system.

Key Features:

- No Staking Support: Enterprise addresses do not include a delegation credential, meaning they cannot be used for staking or delegation. They are purely for handling payments and transfers of ADA and native tokens.

- Simplicity: These addresses are more straightforward than base addresses, as they focus entirely on payments and do not involve any staking functionality.

- Ideal for Business Use: Enterprise addresses are typically used by businesses or individuals who want to make payments and handle transactions without getting involved in the staking ecosystem.

Example Use Case:

If a company or organization needs to transfer or receive payments in ADA but does not want to participate in staking, an enterprise address would be the ideal choice. This address is optimized for transactions without the complexity of staking.

Structure:

- Payment Credential: Controls the ownership of ADA and native tokens.

- No Delegation Credential: The address is used exclusively for payments and cannot be used for staking or delegation.

Comparison of the Three Payment Address Types

| Address Type | Staking Support | Use Case | Key Feature |

|---|---|---|---|

| Base Address | Yes | Payments + Staking | Supports both payments and staking/delegation functionality. |

| Pointer Address | Yes (Indirect) | Efficient Staking Management | References stake credentials via a pointer to the blockchain. |

| Enterprise Address | No | Payments Only | Designed purely for payments with no staking support. |

In the Cardano ecosystem, payment addresses serve different purposes depending on the needs of the user or application. Base addresses are versatile, supporting both payments and staking, making them ideal for everyday users who want to participate in the network’s Proof-of-Stake consensus mechanism. Pointer addresses are more specialized, allowing for more efficient handling of staking certificates. Finally, enterprise addresses are streamlined for entities that only need to handle payments and do not require staking capabilities.

Each of these address types plays a key role in ensuring the flexibility and scalability of the Cardano network, allowing for a wide range of use cases from individual staking to enterprise-level transactions.

Example: A Base Address in Action

A base address, the most commonly used type of address in Cardano, is designed to handle both payments and staking. Suppose Alice wants to send ADA to Bob while participating in staking. Bob’s base address would consist of:

- A header indicating it’s a base address and that it belongs to the mainnet.

- A payment credential tied to Bob’s public key, allowing him to spend the ADA sent to him by Alice.

- A delegation credential linked to Bob’s stake key, enabling him to delegate his ADA to a stake pool and earn rewards.

This structure allows Bob to manage his funds easily while participating in staking, all from a single address.

2. Stake Addresses

Stake addresses in the Cardano ecosystem are specialized addresses used for managing staking and delegation activities. Unlike payment addresses, stake addresses are not used for sending or receiving ADA or tokens. Instead, they are linked to a user’s stake key, which allows the user to delegate their ADA to a stake pool and earn staking rewards. Stake addresses play a crucial role in Cardano’s Proof-of-Stake (PoS) system by securely handling staking-related operations, such as delegation and reward distribution, ensuring that users can participate in network consensus and earn rewards without exposing their funds to transaction risk.

Here are some key bullet points about stake addresses in the Cardano ecosystem:

- Purpose: Stake addresses are used to manage staking and delegation activities, not for regular ADA transactions.

- Stake Key: Linked to a stake key, which allows users to delegate their ADA to a stake pool and earn rewards.

- Secure: Stake addresses are dedicated solely to staking and reward management, ensuring that users can participate in staking without exposing their funds to transactional risk.

- Delegation: Enables users to delegate their ADA to a stake pool and participate in Cardano’s Proof-of-Stake (PoS) consensus mechanism.

- Reward Distribution: Rewards earned from staking are sent directly to the stake address, separate from the payment address used for transactions.

- Immutable: Once a stake address is associated with a stake key, it cannot be altered or used for anything other than staking operations.

- Not for Transactions: Unlike payment addresses, stake addresses cannot send or receive ADA or other tokens; they are solely for staking purposes.

These points highlight the role and functionality of stake addresses in Cardano’s PoS system.

Conclusion

Cardano’s payment addresses are structured to offer flexibility, security, and functionality. With the header, payment credential, and delegation credential, these addresses are not just identifiers for sending and receiving funds—they also enable staking and more complex interactions like multi-signature setups or smart contracts.

As Cardano continues to grow, understanding these three components of a payment address is essential for users and developers alike, ensuring that funds are managed securely while benefiting from the features that the network offers, including staking and smart contract execution. This layered design helps maintain Cardano’s commitment to security, decentralization, and scalability.

Leave a Reply