A Decentralized Exchange (DEX) is a type of cryptocurrency exchange that allows users to trade digital assets directly with one another without the need for an intermediary, such as a centralized exchange or a third-party custodian. Instead, DEXs operate through smart contracts on a blockchain, enabling peer-to-peer transactions in a secure and transparent manner.

Key Features of a DEX

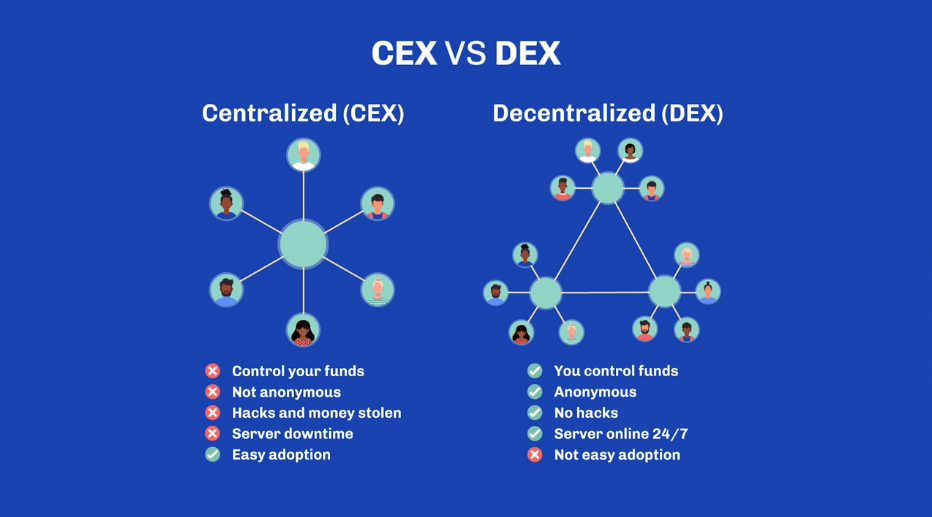

- Non-Custodial: Unlike centralized exchanges, DEXs do not hold users’ funds. Users maintain full control of their private keys and assets at all times, reducing the risk of theft or loss from exchange hacks.

- Smart Contracts: Trades on a DEX are executed automatically by smart contracts—self-executing agreements that enforce the terms of a trade. This eliminates the need for intermediaries and central authorities to oversee transactions.

- Liquidity Pools or Order Books:

- Liquidity Pools: Many DEXs, especially those using automated market makers (AMMs) like Uniswap or Minswap (on Cardano), use liquidity pools where users can deposit their assets to facilitate trades.

- Order Books: Some DEXs use decentralized order books, which match buyers and sellers directly. However, liquidity pools are more commonly used for faster, continuous trading without the need for a counterpart.

- Privacy: Since DEXs do not require users to register or provide personal information, they often offer greater privacy compared to centralized exchanges, which typically require KYC (Know Your Customer) verification.

- Permissionless: DEXs are accessible to anyone with an internet connection and a compatible crypto wallet, allowing users to trade without geographical or regulatory restrictions.

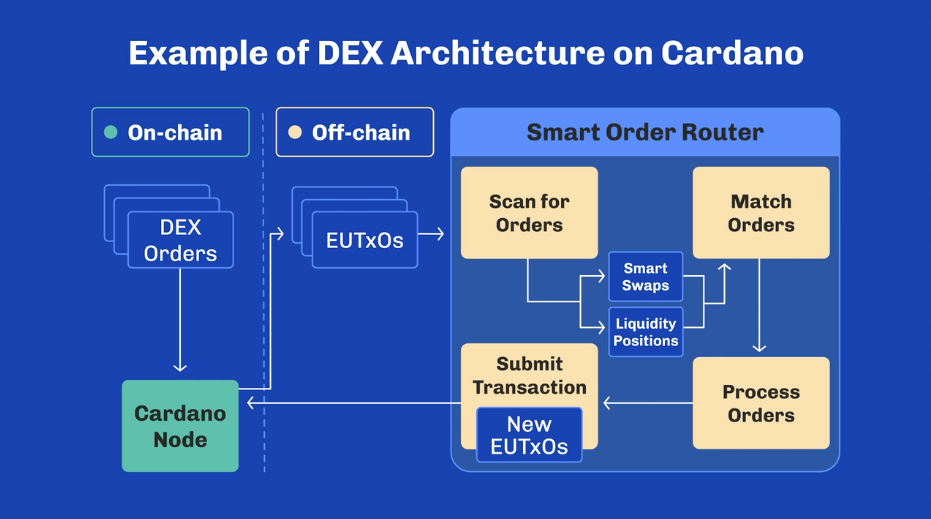

How DEXs Work

On a DEX, users trade directly from their wallets by interacting with the blockchain through smart contracts. These contracts automatically facilitate and settle trades based on predefined rules.

For example, if you’re using Minswap, a DEX on Cardano, you could swap ADA for another token by interacting with a liquidity pool. The smart contract would handle the exchange, updating the pool’s balances, and you would receive your new tokens directly in your wallet.

Advantages of DEXs

- Control and Security: Users retain control of their assets at all times, reducing the risk of loss due to exchange hacks or mismanagement.

- Censorship Resistance: DEXs operate on decentralized networks, making it difficult for governments or authorities to shut them down or restrict access.

- No KYC: Most DEXs allow for anonymous trading, which is beneficial for users who value privacy and wish to avoid KYC processes.

- Wide Range of Tokens: DEXs often support a broader range of tokens, including newer or lesser-known ones that may not be listed on centralized exchanges.

Disadvantages of DEXs:

- User Experience: DEXs can be less user-friendly for beginners, requiring users to manage their wallets and private keys, and understand how smart contracts work.

- Liquidity Issues: Some DEXs may suffer from lower liquidity compared to centralized exchanges, especially for less popular tokens, which can lead to higher slippage or slower trades.

- Gas Fees: On certain blockchains, like Ethereum, gas fees (transaction costs) can be high, making small trades on DEXs expensive. However, blockchains like Cardano offer lower fees.

- Slippage and Impermanent Loss: In AMM-based DEXs, large trades or sudden price fluctuations can result in slippage (where the actual trade price deviates from the expected price) and impermanent loss for liquidity providers.

Example of a DEX: Minswap on Cardano

Minswap is a decentralized exchange (DEX) built on the Cardano blockchain, where users can trade ADA and other tokens directly through liquidity pools. By using an AMM model, it allows traders to swap assets without relying on traditional buyers or sellers, with the smart contract determining the price based on the pool’s liquidity.

In summary, DEXs are an integral part of the DeFi (Decentralized Finance) ecosystem, enabling decentralized, secure, and permissionless trading of digital assets.

Leave a Reply